It demonstrates a balanced approach to managing earnings that can be conducive to sustainable growth. Now it’s time to walk through the calculation and see how Widget Inc. updates its retained earnings to reflect the year’s financial story. Remember, it’s not the amounts in themselves that are important; it’s what they represent about the company’s past and future that really matters to investors and stakeholders.

- The latest statement of financial condition for Brex Treasury LLC is available here.

- The statement of retained earnings is an essential financial statement that provides information about a company’s retained earnings and how they have changed over a specific period of time.

- They increase with a credit entry, and retained earnings decrease with a debit entry.

- You’ve gathered your beginning balance, tallied up the profits or weathered the losses, and decided regarding dividends.

- After you generate your income statement and statement of retained earnings, it’s time to create your business balance sheet.

Are retained earnings a debit or credit?

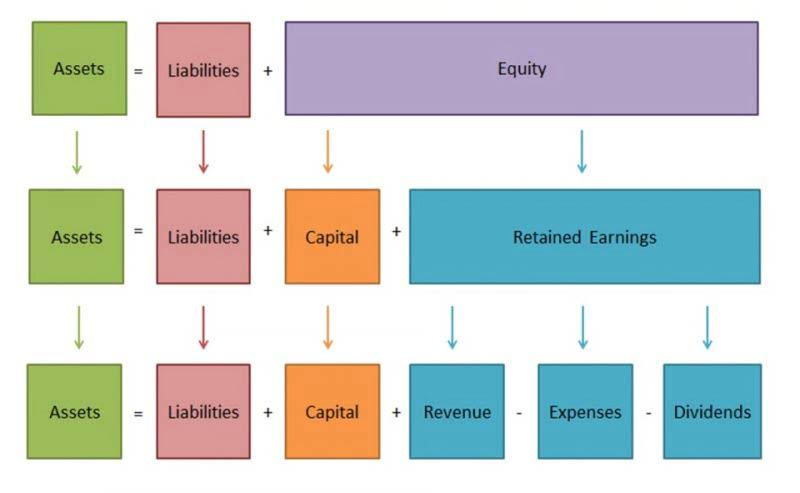

The balance sheet then displays the ending balance in each major account from period to period. Net income from the income statement flows into the balance sheet as a change in retained earnings (adjusted for payment of dividends). While all four financial statements are important for understanding a company’s finances holistically, starting with the income statement can help set the stage for deeper analysis down the line.

How to Prepare a Statement of Retained Earnings

And when it comes to crunch time for fundraising, loans, or investor negotiations, the statement of retained earnings can prove to be an invaluable testament of the company’s ability to pay its own way. If there are any adjustments required for prior period errors or changes in accounting principles, these should be added or subtracted from the adjusted retained earnings. These adjustments ensure that the retained earnings reflect the true financial position of the company. Investors, lenders, and vendors might be interested in checking out your business’s cash flow statement. You can even use your cash flow statements to create a cash flow forecast or projection.

The Basics of Statement of Retained Earnings

Absolutely, retained earnings can be distributed among shareholders in the form of dividends. This payout is at the discretion of the company’s management and board of directors. So, $14,500 would be the final figure to strut onto your balance sheet, ready to roll into the next period’s retained earnings calculation. Should your company decide to pay dividends, the exact amount you distribute nibbles away at the net income’s contribution to retained earnings.

- Articulation refers to the ability of financial statements to connect and flow together seamlessly.

- The concept of retained earnings and preparing a statement to report them has been used since the early 20th century.

- This article will detail what retained earnings are and show an example of how it looks in practice.

- Calculating the ending retained earnings isn’t just a mere formality—it’s a powerful indicator of economic endurance and fiscal foresight.

- This subtracts directly from your cumulative profit reserves, and it’s pivotal to document it accurately.

- It’s a narrative you write with care, knowing each chapter influences the future of the company.

Can a company have negative retained earnings?

The statement of retained earnings is also called a statement of shareholders’ equity or a statement of owner’s equity. The last line on the statement sums the total of these adjustments and lists the ending retained earnings balance. In other words, assume a company makes money (has net income) for the year and only distributes half of the profits to its shareholders as a distribution.

- But a retained earnings account is reported on the balance sheet under the shareholders’ equity, so they’re treated as equity.

- They review the company’s income statement for the current fiscal year, which shows that the company had a net income of $100,000 for the year ending December 31, 2022.

- Dividends are distributions of the company’s profits to its shareholders, decreasing the retained earnings balance.

- It’s often an alert to investors and managers to review the company’s financial health and strategies.

- The three financial statements are (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

As a key indicator of a company’s financial performance over time, retained earnings are important to investors in gauging a company’s financial health. This post will walk step by step through what retained earnings are, their importance, and provide an example. Prepare your cash flow statement Accounts Payable Management last because it takes information from all of your other financial statements.

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. The statement of retained earnings is a helpful tool for XYZ Ltd. and bookkeeping its stakeholders. It provides insight into the company’s financial health, as the increased retained earnings demonstrate its ability to keep profits for future use.

What Are the Types of Financial Statements?

Then, list out any expenses your company had during the period and subtract the expenses from your revenue. The bottom of your income statement will tell you whether you have a net income or loss for the period. The income statement is first, followed by the the statement ofowner or stockholder’s equity balance sheet, and last the cash flowstatement. By preparing the income statement first, companies can gain insight into their operating performance and identify areas where they may need to make changes or improvements. For example, if revenue is declining while expenses are increasing, this could signal that the company needs to adjust its pricing strategy or cut costs in certain areas. This statement includes all sources of revenue earned by the company during that period, including sales revenue and other operating income.

The statement of retained earnings shows the amount of earnings being retained as equity and the earnings being paid out as dividends. This information is essential for investors because it provides insight into the company’s financial stability and the potential for future dividend payments. The statement of retained earnings is an essential financial statement that provides information about a company’s retained earnings and how they have changed over a specific period of time. A negative retained earnings balance signals that a company has accrued more losses or paid more dividends than it has earned. It’s often retained earnings statement an alert to investors and managers to review the company’s financial health and strategies. Net income is like the heartbeat of your company’s financial health, pulsating through the veins of your statement of retained earnings.