Typically made quarterly, these announcements are closely scrutinized by investors, analysts, and the media. Beyond releasing financial results, companies must contextualize them to align with market expectations and strategic goals. what is financial transparency Timing is key, with announcements often coordinated after market hours to give stakeholders time to process the information. Insider trading laws prohibit trading based on non-public, material information, requiring companies to establish compliance programs to prevent unauthorized disclosures. The Foreign Corrupt Practices Act (FCPA) imposes anti-bribery provisions, necessitating robust internal controls and accurate record-keeping, particularly for multinational corporations.

Tools and Technologies for Monitoring Financial Transparency Metrics

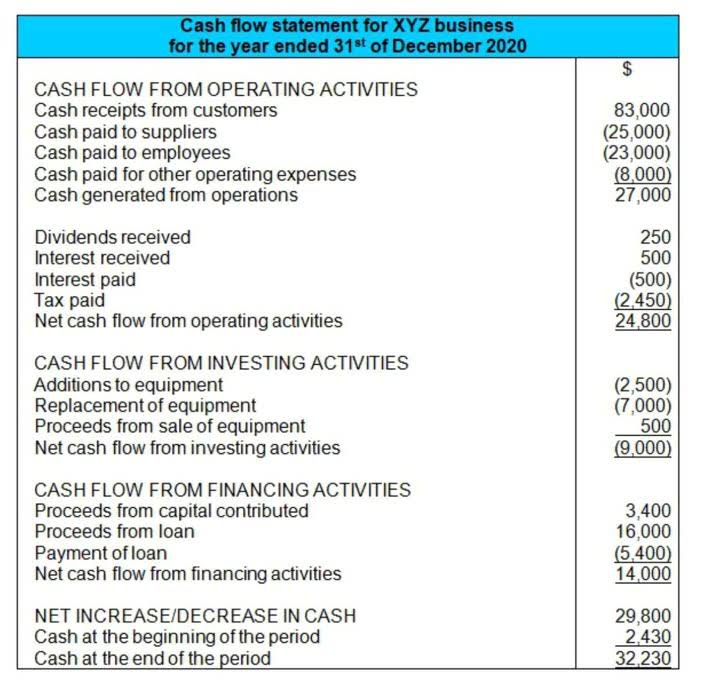

Financial transparency is important as it helps to build trust and confidence among stakeholders, as well as to demonstrate accountability and integrity. It also allows for better decision-making, as stakeholders can make informed judgments about an organization’s financial health and performance. Organisations should not only provide annual reports but also engage in ongoing dialogue with investors, employees, and customers about their financial performance. This could involve hosting quarterly earnings calls, publishing newsletters that highlight key financial metrics, or utilising digital platforms for real-time updates. As investors, we base our investment decisions largely on the financial statements that each company provides. Therefore, it’s crucial to stick with Online Accounting companies that are transparent about their financial reporting and avoid ones that obfuscate the numbers.

How far back is the data that populates “Graduated Status Reconciliation” reviewed?

Embedding financial transparency into your corporate DNA is not just a practice; it’s a strategic advantage. Companies that prioritize transparency can create stronger, more engaged teams, better decision-making processes and improved stakeholder trust. Furthermore, the rapid pace of technological change means that organisations must continually adapt their reporting practices to keep up with new tools and methodologies.

ADM CFO: Key Responsibilities and Strategic Financial Leadership

Thus, to even further increase budget transparency, governments need to provide more comprehensive budget information. This can be an issue of a government’s capacity, and so donors and civil society can support progress by providing technical assistance. Note that, as explained above, an institution may also be treated as not financially responsible if the Department terminates the eligibility of one of its programs under a Subpart G action.

At the same time, FINQ’s clear and comprehensive portfolios provide clients with unparalleled insight, making investment decisions more informed, empowering, and based on an unbiased, unfiltered view of the market. When it comes to ensuring transparency and accuracy in financial reporting, one of the best practices involves leveraging the Medical Billing Process expertise of financial professionals. This means hiring or consulting with accountants, auditors, and financial analysts with the skills and knowledge to manage and report your company’s financial data accurately. With access to key financial data, your employees can make better choices about what’s best for the company. Being open and transparent about all your financial information enables leaders in your organization to assess risks and identify opportunities for growth.

- The recognition criteria determine whether an item qualifies as an asset and should be included in the balance sheet.

- These best practices guide auditors in conducting thorough, objective, and meaningful audits that contribute to the organization’s financial transparency efforts.

- The continued development and implementation of robust accounting standards are essential for fostering transparency and maintaining confidence in the financial reporting process.

- Only students who received Title IV aid at any time from your institution for the completed program should be included in your Draft Completers List.

- If a stock, for example, is underperforming while the industry is doing well, it might be a red flag.

As innovative startups and forward-looking companies have shown, embracing financial transparency goes beyond mere numbers on a balance sheet—it’s about nurturing trust and empowerment within your organization. Transparency in finance refers to the clear, accurate, and accessible presentation of financial information, which ensures that stakeholders can easily understand and trust an organisation’s financial activities. Compliance with financial regulations requires businesses to submit accurate and timely filings to regulatory bodies. Failure to meet disclosure requirements can result in penalties, legal consequences, and reputational damage. Businesses handling international transactions need exchange rate data from the Federal Reserve or the European Central Bank.

Financial Literacy Matters: Here’s How to Boost Yours

- His day job is running a small solo practice called G3CFO where he helps small business leaders grow their financial leadership capabilities in times of growth, renewal, and hardship.

- Our comprehensive support system includes a worldwide network of mentors, investors, and strategic partners, allowing us to transform ideas into scalable, market-ready businesses.

- They also have no standards for structuring information and feature identifier codes that are frequently inconsistent with each other.

- OneMoneyWay is your passport to seamless global payments, secure transfers, and limitless opportunities for your businesses success.

- By regularly monitoring these metrics, management can identify inefficiencies or areas for improvement in their financial processes.

To foster clear communication, you must establish trust and nurture important connections with all the people involved in your finances. Consider promoting integrity, truthfulness, and responsibility among staff members who are involved in your financial affairs. Transparency for your employees also helps them to understand the reasons behind certain decisions, leading to better morale and more motivation among team members. Make sure you visit the FVT/GE page on Compliance Central for convenient access to all our resources on signing up for, activating, and using our FVT/GE reporting solution.